Undervalued and Mispriced – Lack of Water Risk in Capital Markets

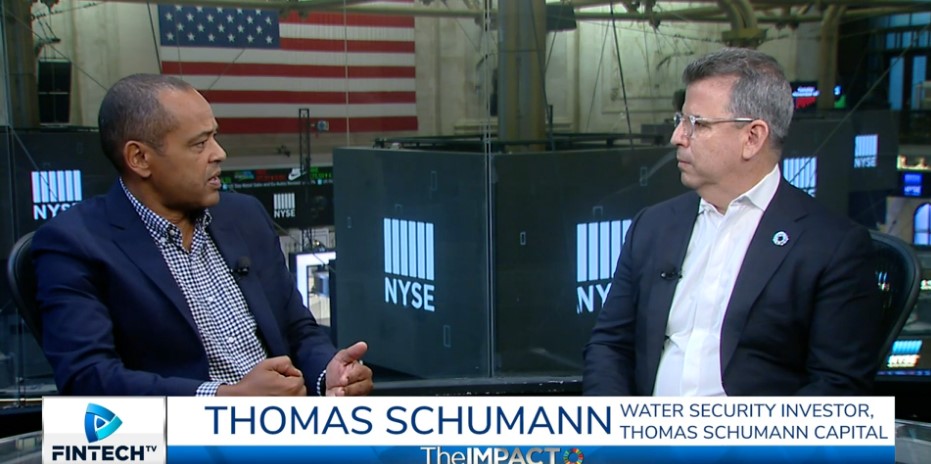

TheIMPACT is back at the New York Stock Exchange! In this week’s show, Jeff interviews Thomas Schumann about the TSC Water Security Index, the world’s first benchmark index quantifying water risk in equities.

“Water risk is embedded in all asset classes, in every investment decision, and every allocation.” 1

Defining water is critical. According to Schumann, water is not a commodity. It is a precious resource and a human right that is recognized by the United Nations. Mainstream media often speaks of commodification, monetization, and commercialization of water, which misaligns its value. Schumann believes water requires integrity, stewardship, and custody — qualities which led to the development of the Water Security Index.

Neither MSCI, ACWI, S&P 500, nor the FTSE have considered climate risk in their benchmark indices. So, to date the risks have neither been recognized nor priced into the markets, which is a big problem. Watch the full episode to learn more about the first ever water footprint for capital markets.

Upcoming Event: Join us on December 8th at 1:00 PM ET

Climate Change Investment and Corporate Engagement Grow the New Energy Economy

Paul Ellis, Host of The Sustainable Finance Podcast (SFP) & Panelists

Investment experts to learn:

-Why ESG investment strategies are outperforming

-How asset managers are adapting to the increasing flow of ESG AUM

-Where investors and advisors can learn more about ESG investment

Panelists Include:

Aisha Williams – Founder and CEO at ImpactVest, Certified Expert in Sustainable Finance, Harvard Business Review Advisory Council

Jeff Gitterman – Co-Founding Partner and creator of Sustainable, Impact, and ESG Investing Services at Gitterman Wealth Management, LLC.

Diana Glassman – Director-Engagement, EOS at Federated Hermes

______________________________

[1] https://fintech.tv/thomas-schumann-water-security-investor-thomas-schumann-capital/