SMART (Sustainability Metrics Applied to Risk Tolerance)® Investing Solutions for Financial Professionals

Our SMART models are a family of global climate-aware allocation strategies. They are core holdings, tailored for risk tolerance, designed for above average risk-adjusted returns, and deliver the meaningful impact investors seek.

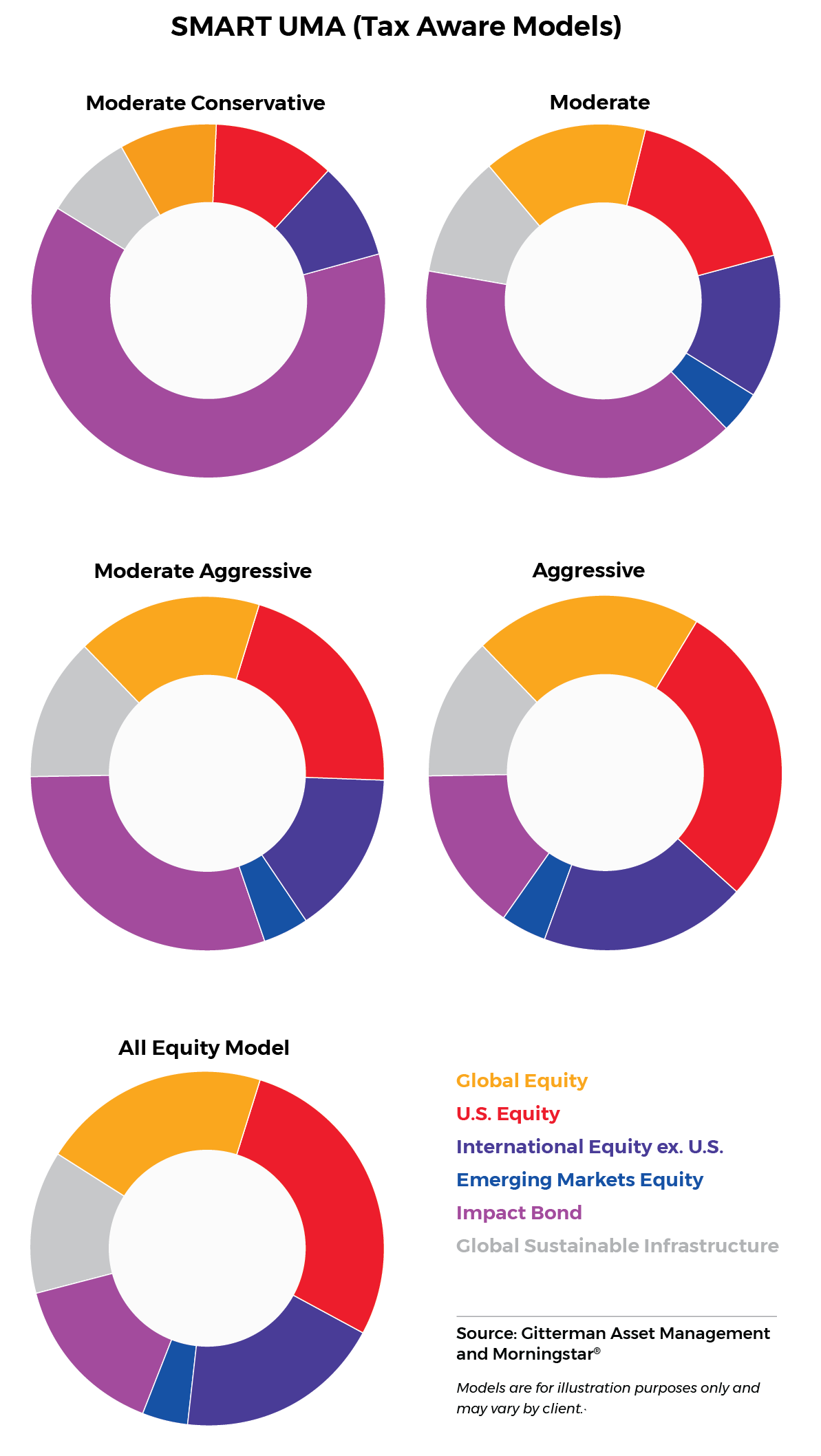

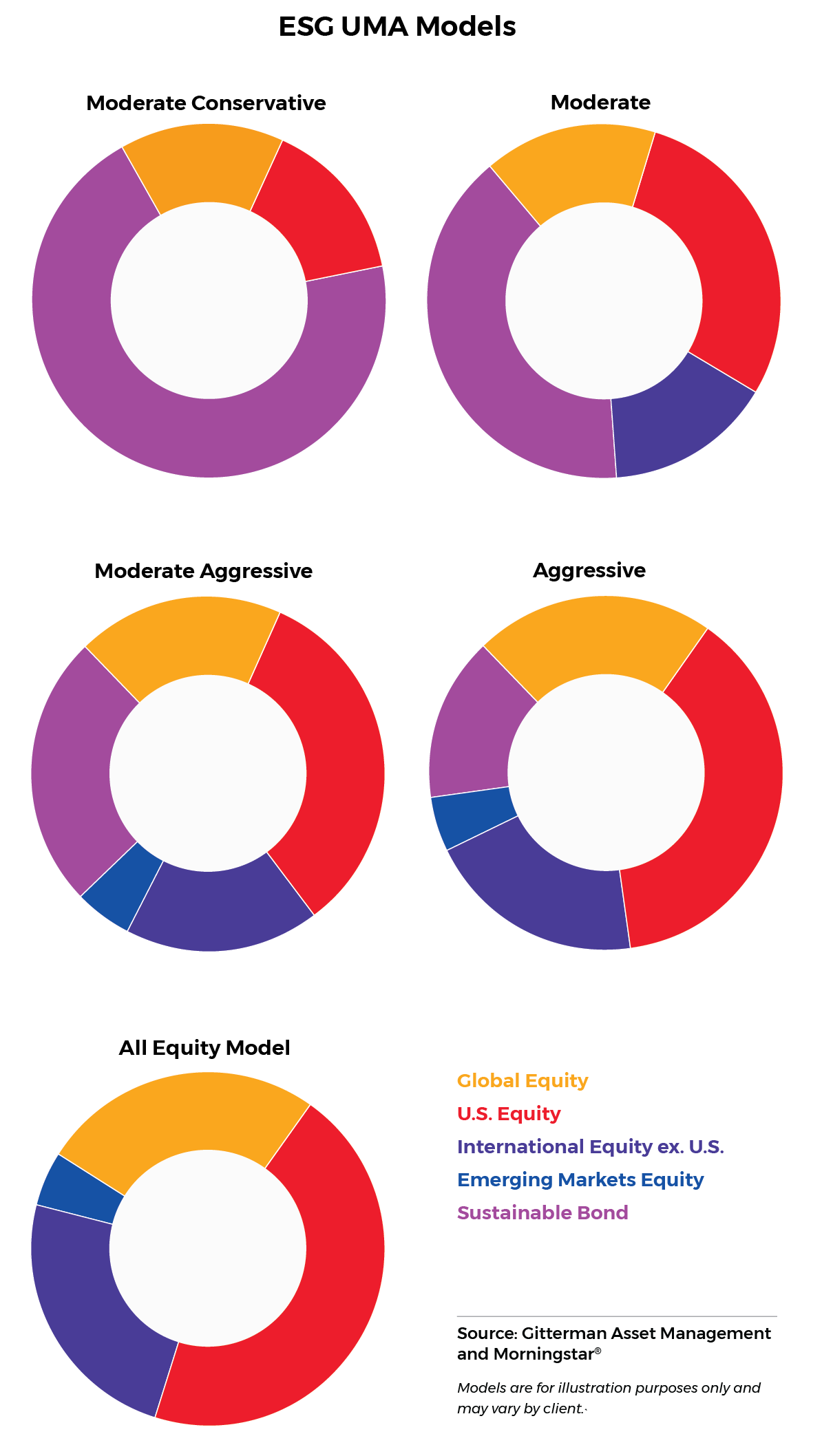

SMART Climate Unified Managed Account (UMA) Models

- Our climate-focused UMA models comprise actively managed Separately Managed Accounts (SMAs), across four risk iterations, and an all equity version

- We include managers who use cutting edge climate science to incorporate physical climate risk alongside boutique and emerging managers normally unavailable in a UMA format

- Our models also benefit from market-leading tax overlay capabilities, including customized tax-loss harvesting and flexible transition management from existing investments, powered by Natixis*

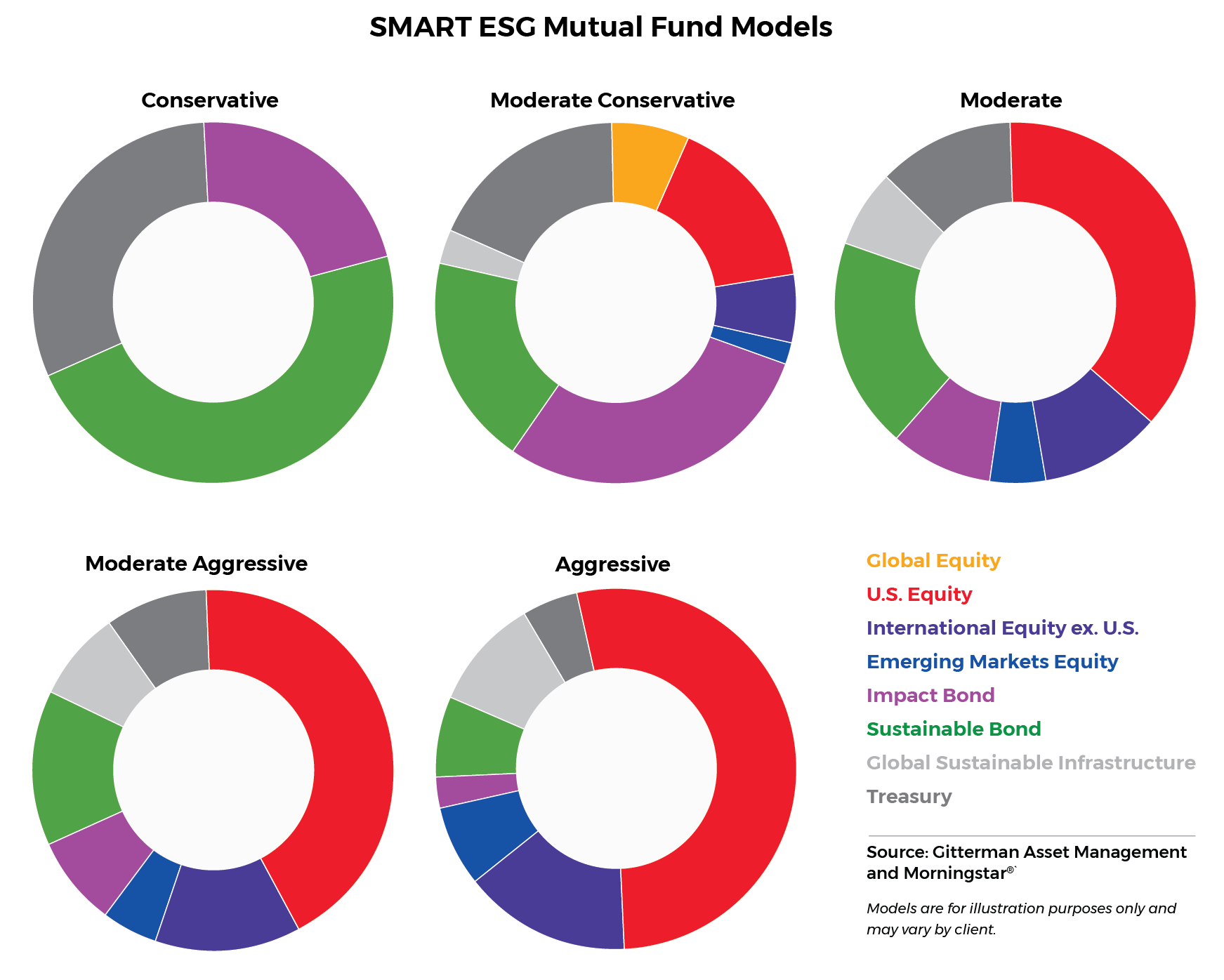

SMART Managed Mutual Fund Models

- We offer ESG models comprising mutual funds and ETFs, across five risk iterations

- Our models include managers with strong performance track records, sophisticated ESG integration, and firm-level commitments to sustainability

* Gitterman Wealth Management, LLC and Natixis Advisors, L.P. are separate and distinct federally regulated entities.