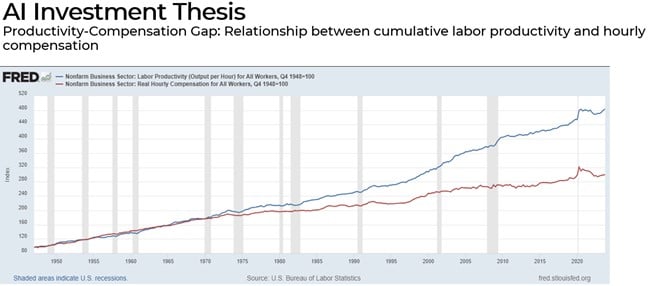

Source: US Bureau of Labor Statistics. Data as of 3/7/24.

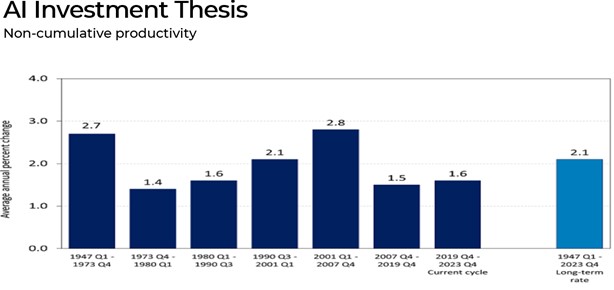

It is also worth noting the timeline around technological innovation and an ensuing surge in productivity. Not all innovations positively transform daily life. Economic historian Robert C. Allen dubbed this effect Engels’ pause; a productivity-enhancing technological innovation first displays an apparent drop in productivity growth because realizing their potential also requires significant investments and a fundamental rethinking of organizations. The Productivity J-Curve that Engels’ pause suggests should make investors wary of early successes in introducing AI into business. Productivity growth has averaged 3.9% in the last three quarters, more than triple the rate in the decade before the pandemic. When workers are more efficient, firms can generate more money to raise wages without charging higher prices so that monetary policy can be less concerned about inflation. While Wall Street has been focused on how artificial intelligence and innovations such as ChatGPT will drive efficiencies, lifting technology stocks to record highs, the 2023 boom has resulted from more mundane factors. One is an economy at full employment, with workers gaining experience and skills. According to Employ America, another element is investments from Joe Biden’s administration in plants and semiconductors, as well as spending from the Inflation Reduction Act. The Fed’s official forecasts share that conservatism, predicting long-term growth of around 2%, suggests a productivity rate of around 1.5% with a labor force growth of around 0.5%. Jay Powell said that’s probably still being affected by the pandemic, and it may well be that when all is said and done, productivity growth shakes out after the pandemic and more or less at the pace it was before the pandemic, which is closer to 1 to 1.5%. A step up in productivity could lead to a “roaring 2020s” for economic growth, said Ed Yardeni, president and founder of Yardeni Research. He estimates that productivity might increase 2.5% or more annually for the rest of the decade, much faster than the Fed’s estimates.

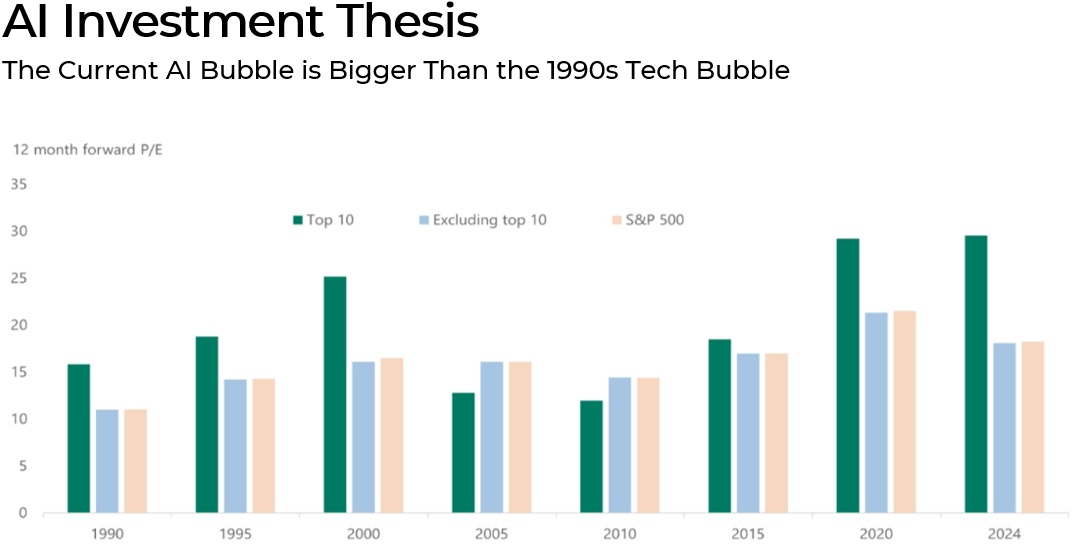

To see what needs to happen for AI to spill over all economic sectors, one can look at the extent to which S&P 500 companies invest in the future through their capex effort, measured as the capex/sales ratio. If AI is the future, like the internet was in the early 2000s, the capex to sales ratio was significantly higher than now, even after considering all the investment from the CHIPS Act aimed at catalyzing semiconductor infrastructure spending. For the productivity thesis to play out, corporate America should be making a much higher capex “effort” than it’s making today.

Resource constraints

The semiconductor and data center development landscapes are experiencing a rapid evolution characterized by a surge in construction and investment. Deutsche Bank Research highlights the initiation of 18 new chipmaking facilities between 2021 and 2023, while the Semiconductor Industry Association notes over 50 new semiconductor ecosystem projects announced in response to the CHIPS Act. This legislative initiative injected $53 billion of public funds, sparking an additional $166 billion in private investment within the semiconductor ecosystem. Forecasts indicate that major tech companies are poised to funnel $1 trillion into this sector over the next five years, primarily toward data centers. The United States is witnessing a semiconductor manufacturing boom driven by efforts to bolster domestic production and mitigate supply shortages. Industrial Info Resources monitors over $300 billion worth of active semiconductor projects at various stages of development, underscoring the sector’s momentum. New York, Arizona, Texas, and Virginia have become primary beneficiaries of recent semiconductor and data center expansion, attracting significant investment. The proliferation of AI is reshaping both digital landscapes and physical infrastructures. According to the Synergy Research Group, the global count of “hyperscale” data centers doubled from 2015 to 2020, with nearly 40 percent located in the United States and predominantly owned by industry giants like Amazon, Google, and Microsoft. Additionally, the U.S. hosts approximately 1,800 “colocation” data centers, albeit smaller in scale yet resource-intensive due to diverse operational requirements. Understanding the growth trajectory and the geographic distribution of AI infrastructure sets the stage for examining looming resource constraints. While AI models’ carbon footprint and energy consumption, like GPT-3, have drawn public attention, the significant water footprint remains largely overlooked. Addressing these challenges will be crucial to sustaining the industry’s projected growth trajectory and mitigating environmental impacts, thus aligning technological advancement with broader sustainability goals.

Energy

The recent acknowledgment by OpenAI’s CEO, Sam Altman, at the World Economic Forum in Davos signals a sobering reality for the artificial intelligence (AI) industry, an impending energy crisis. Altman’s warning underscores the exponential energy demands of forthcoming generative AI systems, which are anticipated to surpass conventional estimates. Generative AI-driven searches, for instance, are projected to consume four to five times more energy than traditional web searches, exacerbating the strain on energy systems. The energy-intensive nature of AI operations, notably within hyperscalers like Meta, Amazon.com, Microsoft, and Google, has led to a threefold surge in energy consumption since 2018. While these companies have made strides in adopting renewable energy, such efforts will compete with emerging clean technologies like electric vehicles (EVs) and hydrogen for energy consumption needs. Data center energy needs are projected to triple by 2030, reaching 5% of global demand without substantial efficiency enhancements.

The push for electrification as a climate-friendly strategy faces its own challenges, particularly regarding meeting clean-energy targets amidst escalating demands from AI and EVs. Although AI promises environmental benefits such as predictive maintenance and real-time energy-consumption analysis, the surge will still strain the grid and threaten to worsen the climate crisis. The proliferation of data centers, exemplified by Amazon’s expansive infrastructure in northern Virginia, underscores the scale of energy consumption. Amazon’s 102 data centers, equipped with emergency generators in Virgina alone are capable of producing over 4.6 gigawatts of power (almost enough energy to power NYC for a day), highlight the immense strain on energy grids. Training AI models like GPT-3 further exacerbates energy demands, with estimates revealing significant emissions and electricity consumption for model training.

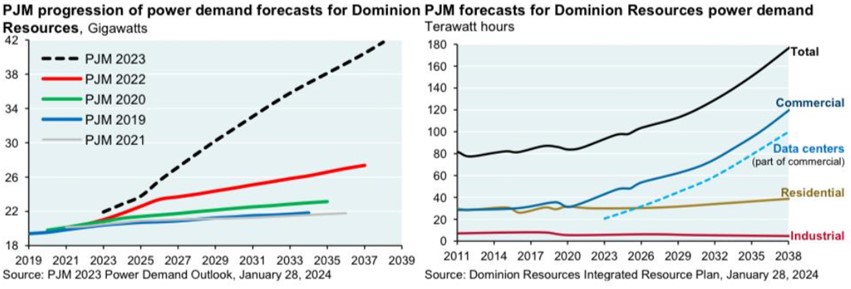

The confluence of AI and EV growth strains existing energy infrastructure, heightening the risk of grid failures without substantial increases in energy production that can handle peak demand flareups. While renewables show promise, current output and storage capacities are insufficient to meet escalating demands, precluding a return to traditional-based energy production. Nuclear energy has emerged as a viable option due to its capacity and base load utilization potential, albeit hindered by political challenges in the U.S. This underscores the urgent need for comprehensive energy strategies to support the burgeoning AI industry while mitigating environmental impacts sustainably. The below image illustrates the power demand forecast of the Pennsylvania, Jersey, Maryland Interconnection (PJM), a regional transmission organization that coordinates the movement of wholesale electricity to a large portion of the East coast, for a specific utility, in this case Dominion Resources. Clearly you can see the expectations for data center energy consumption for grid operators and utilities.