As the climate becomes less stable, we believe it will lead to a reshuffling of the entire system, starting with the most vulnerable sectors: Insurance markets begin to crack, as we are now witnessing across… Read more »

News + Insights

Q3 2025 Market Commentary: Investing in the Infrastructure of What Comes Next

The combination of our climate adaptation and energy addition theses continues to drive outperformance vs. the major indexes. This is evidenced by performance this year across key industries such as water utilities (+58.37%),[1] independent power… Read more »

Second Order Exposure to AI

What we have been framing as climate adaptation and resilience investments are increasingly becoming necessary capacity-building systems for a digitized, electrified, and multipolar world. We believe that leaning into second-order exposure and companies that are… Read more »

Special Guest Ben Cooke, KBI Global Investors: Gitterman Q3 2025 Market Outlook Webinar

This quarter’s webinar will also feature a fireside chat between Jeff and Ben Cooke, Portfolio Manager, Natural Resource Strategies at KBI Global Investors, examining how Europe’s commitment to climate infrastructure has yielded early alpha, and… Read more »

Q3 2025 Market Outlook Webinar: Infrastructure and a Shifting Macro Regime – Wednesday, July 23rd @ 1:00 – 2:00 PM ET

This year, net-zero infrastructure (+13.97% YTD) [1], transition metals (+14.95% YTD) [2], and renewable energy (+16.11% YTD) [3] have dramatically outpaced the S&P 500 (+6.06% YTD) [4]. This performance marks real-time confirmation of our thesis… Read more »

The Future of Muni Bonds: Climate Change and Market Implications

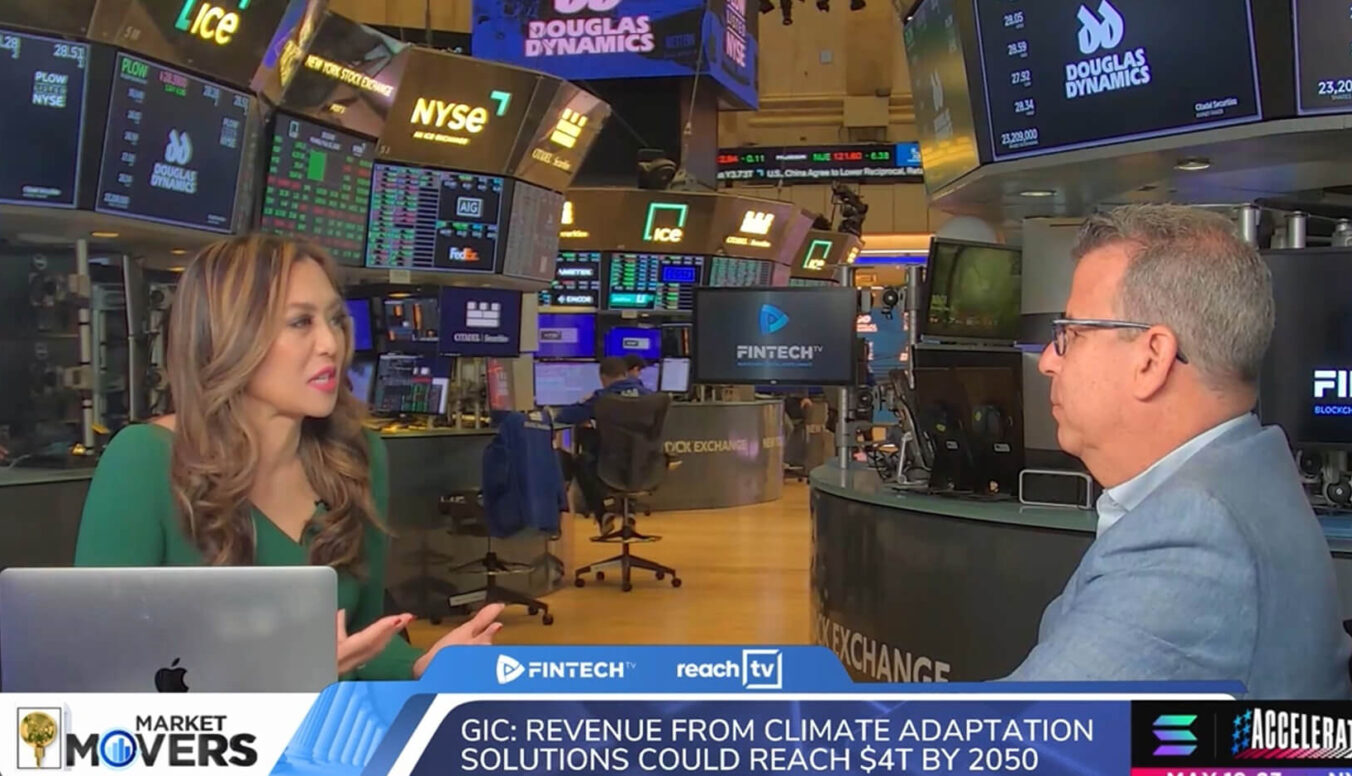

Why aren’t the municipal bond markets pricing in climate risk? Jeff recently sat down at the NYSE with Tom Doe, CEO of Municipal Market Analytics, an independent research firm providing strategic analysis and insights on… Read more »

J.P. Morgan: The Future of Water Resilience in the U.S.

As another follow up to our recent post, J.P. Morgan Touts Huge Returns Around Climate Adaptation, Jeff recently sat down at the NYSE to speak with Dr. Prad Parhi, Executive Director, Commercial and Investment Bank… Read more »

The Inevitable Investment Opportunity

In step with our last blog post, JP Morgan Touts Huge Returns Around Climate Adaptation, Singapore’s sovereign wealth fund, known as GIC Pte. (or the Government of Singapore Investment Corporation), has also co-authored a report… Read more »

J.P. Morgan Touts Huge Returns Around Climate Adaptation

J.P. Morgan recently released a report titled, Building Resilience Through Climate Adaptation. The report notes that many climate investors are disproportionately focused on mitigation, which typically takes the form of emissions-cutting technologies and accounts for… Read more »

Q2 2025 Commentary: Investing at +1.5° C

Much of the first quarter of 2025 has been dominated by global politics, tariffs, macroeconomic uncertainty, and the latest breakthroughs in artificial intelligence. But amid the noise, one critical lens has noticeably dimmed: climate and… Read more »